Can You Get Car Insurance if You Don& 39

Martin's Car & Home Insurance Warning

'Rules revolution. Cheap switchers' deals may end soon. Check now if you can lock in cheaply, even if not at renewal.'

The 12 things you need to know

On 1 January 2022,  regulator the Financial Conduct Authority brings in new insurance rules. They primarily apply to vehicle insurance (car, motorbike, van) and home insurance (buildings & contents), but it's a monumental shake-up - the biggest I remember.

regulator the Financial Conduct Authority brings in new insurance rules. They primarily apply to vehicle insurance (car, motorbike, van) and home insurance (buildings & contents), but it's a monumental shake-up - the biggest I remember.

The aim is to end price walking, where those who loyally renew each year are penalised by seeing their prices put up - while new customers get the best deals. There's full car insurance cost-cutting and home insurance cost-cutting help on the site, but here's what you need to know and do about the new rules.

1. From 1 Jan, car & home insurers must charge new and existing customers the same.

I can hear the cheers. The loyalty premium has long been a bone of contention. It's great news for those who don't switch, or do but don't want the hassle. The rules say insurers must prove, on aggregate, that they charge new and existing customers the same, including any vouchers or cashback.

It's 'channel specific' too. For example, an insurer must give all customers renewing who first came via MoneySupermarket the same prices as new customers via it - but these can differ from prices via Gocompare.

2. My guess is firms won't just cut renewals to match newbies' prices. They'll drop 'em somewhat, and increase new-customer rates - meeting towards the middle.

That's why we may see an end to many cheap switchers' deals. I need to be plain here - I don't know that this will happen. My guess is based on similar past changes. The easiest example is from 2012, when insurers were barred from price discrimination based on gender...

Young male drivers had paid far more than female drivers. After we tried to factor out other price moves, it looks like young women saw prices rise, while young men saw them drop by even more.

Don't think savings by switching will end totally though. Different insurers will still have different prices - and new entrants will try to disrupt the market - but savings will likely be smaller.

3. Rates may change before January, so checking now, while they're still cheap, is safest - you can switch even if not at renewal.

While the new regime officially starts in January, as it's a big job, insurers will likely start to shift pricing algorithms sooner, so the clock is ticking and the cheapest prices may start to disappear within weeks or months.

The tips below will show you how to find cheap car insurance and cheap home insurance. Take a look even if renewal is six months away, to see if you can save significantly.

If you can, you'll need to cancel your existing policy, and provided you've not claimed or reported an incident this insurance year...

- You should get a pro-rata refund for the rest of the year minus a £30 to £50ish one-off admin fee. Factor that in to any savings.

- You might not earn this year's no-claims bonus though.

As Holly emailed us: "I'm so glad to get your emails. I wouldn't have thought to cancel my car insurance mid-year and start a new one which is £300/yr less." More help on how to save if not at renewal.

Even if you can't save now, but can match your current price, it may be worth doing in case prices rise. This is far shakier territory though, as it involves some crystal-ball gazing. So I'll leave it up to you.

4. Use more than one comparison to find your cheapest.

Comparison sites are actually technically insurance marketplaces, as insurers are allowed to, and sometimes do, offer cheaper prices on individual sites than they charge direct.

Therefore it's not just that different sites cover different firms, but that different sites can have different prices for the same insurer. So for the widest comparison use at least two, and more if you've time.

Below is our current order to try (see how we pick the order). Though checking as many as you've time for is the key rule, rather than the order, so if any perks appeal, you can select your order based on that.

| CAR INSURANCE COMPARISON ORDER |

| Confused.com* car insurance Official perk info: ONE of a... £20 Halfords voucher | £20 Domino's voucher | 12 IMO 'triple foam' car washes | Hello Fresh recipe box. |

| MoneySupermarket* car insurance |

| Compare The Market* car insurance |

| Gocompare* car insurance |

| Comparison sites are best for those with straightforward circumstances. If your situation isn't mainstream, see help to get cover. |

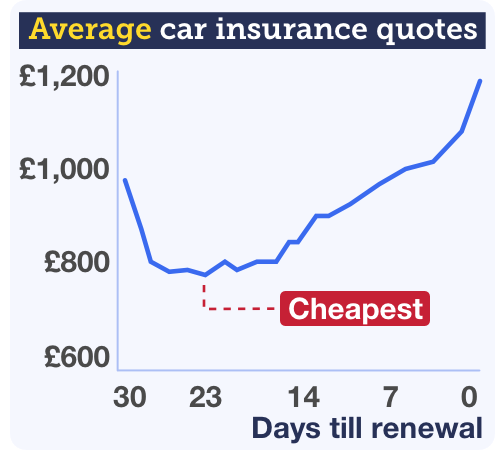

6. Near renewal? Get quotes 23 days beforehand - leave it later and you can see prices double...

While today I'm pushing you to check if you can save regardless of timing, for those with renewals soon, timing can really help.

While today I'm pushing you to check if you can save regardless of timing, for those with renewals soon, timing can really help.

We analysed over 70 million quotes, and found the optimum time to get new car insurance quotes is 23 days ahead of renewal (21 days for home), but anytime around three weeks is good. Leave it later and car insurance prices can almost double because insurers' algorithms show those who get new quotes earlier are a lower risk (the rise is far less steep with home insurance).

We get huge numbers of successes on this. Ian emailed: "Brilliant advice - best price, about 21 days before expiry date, was £340. But day before expiry: £637."

Amanda emailed too: " I read your tip... and got a quote for £600 less than the renewal quote. Saved £960 total because I could now afford to pay in one go rather than monthly instalments. Thank you ."

7. More than one car in the home? Multicar policies could save or cost you £100s...

Multicar insurance policies aren't included on comparison sites, so to find out if you'll save requires digital elbow grease.

Multicar insurance policies aren't included on comparison sites, so to find out if you'll save requires digital elbow grease.

My rule of thumb is first try the opposite to what you have, as insurance has always been about sucking in newbies with special deals. So if you've multicar, try standalone policies. Got standalone? Then try multicar.

The three pure multicar discount policies are from Admiral MultiCar*, Aviva* and LV*. All let you set up a policy at your 1st car's renewal, leaving the other car(s) on its existing insurer until their renewal. See multicar split-year renewals.

There are also multi-policy discounts, reducing the cost if you've two cars, or get car and home insurance together. These include More Than (15% off), Axa* (up to 15%), Esure* (10%), Privilege (varies) and Sheilas' Wheels* (10%). Plus, Direct Line* and Churchill also offer discounts for multiple cars.

Multicar worked for Kam, who told us on Facebook: "I saved £500by sticking both my and my wife's car on a multicar policy."

But Nigel tweeted that splitting was better:" @MartinSLewis I was with multicar until at renewal they wanted over £1,300 for 3 cars. Got 3 individual policies for under £600. "

8. Cashback sites can pay up to £70 if you get a policy via them, boosting your saving.

If you're a cashback site user, you'll know that if you get your car and home insurance via it, and it's paid a lead fee for sending you to the insurer, then it shares it with you as cashback.

Yet do check your quote isn't more than via a comparison site. Plus think of the cashback as a bonus rather than 100% certain, as sometimes it doesn't track or isn't paid out - focus on the right product. Full info in car insurance & cashback, but there are two routes to try...

- Route 1: Use cashback site comparisons.A rebranded version of Confused's comparison is used by cashback sites Topcashback* (get £40 for car, £32 home) and Quidco* (£35 car, £28 home) - though you don't get the normal Confused perks.

What I can't say is whether you'll get exactly the same price as going to Confused direct. This week, we got a small sample, 17 people from MSE Towers, to check. Nine got the same price from both cashback site comparisons as Confused, three got it cheaper, five more costly - but that could be due to dynamic pricing.

- Route 2: Find your cheapest policy, then try for cashback.This may be more lucrative. Once you know your cheapest insurer after using a comparison site, check what cashback you'd get going to it direct via Quidco* or Topcashback*. You could get up to £70 for car insurance and £50 for home.

Yet be extra careful not to let the cashback tail wag the dog. Choose the right insurer first, then look for cashback. Don't choose the biggest cashback to make your choice of insurer.

10. Ensure you're insuring your HOME & contents correctly.

Buildings insurance is normally only for freehold property owners - leaseholders and renters will usually be covered by that (though some leaseholders' circumstances may be different - so check). Do be careful not to overinsure buildings cover - cover the cost to rebuild it if knocked down, not to buy it. Use a rebuild cost calculator.

Everyone should consider contents insurance. An easy way to think of the difference is if you could upend your home, whatever falls (plus integrated items such as white goods) is its contents. Do beware underinsurance contents though, as you may not get a full payout.

11. Don't want to move... haggle.

If you're happy where you are, ask your insurer to match the cheapest quote / best deal - it may even be from your same existing insurer, as the new rules haven't come in yet. Full help inCar & home insurance haggling (pls remember it's about charm and politeness, not aggression).

As Paul emailed: "Did the usual searches and then contacted my insurer. Got the price down from £2,500 to just over £1,900. Pays to haggle. "

12. Ensure the policy is right for you and know your rights if you're unfairly treated / your claim is rejected.

Before you sign up to a policy, spend time going through what it covers and the details to make sure you're happy with it, and check it is regulated by the Financial Conduct Authority.

If you believe your insurer has treated you unfairly, or rejected a claim it shouldn't, remember you have a right to take it to the independent, freeFinancial Ombudsman Service for it to adjudicate.

Can You Get Car Insurance if You Don& 39

Source: https://www.moneysavingexpert.com/tips/2021/10/13/

0 Response to "Can You Get Car Insurance if You Don& 39"

Post a Comment